Everyone who knows me, knows that Quarterly Release time is my favourite time of the quarter, as I love finding out all the new features that Oracle have released. Payroll is mandatory in Redwood by release 25C, therefore there isn’t a large number of new features for Global Payroll in this release, but there are still some significant changes! Oracle will continue to roll out new features throughout the quarter. If any additional updates stand out, I’ll share a follow-up blog to keep you informed.

The first key point of note is that the Payroll Activity Centre will be automatically switched on in 25C. Given that it’s a really helpful tool, I would imagine this won’t cause any Payroll users hassle, but I wanted to flag it in case any organisations have delayed their move to Redwood for Payroll. If you don’t know what the Payroll Activity Centre is, it’s a one stop shop for all your payroll needs. You can run flows, check person results and do all of your usual Payroll transactions from one place. I’m a massive fan of all the activity centres, but this one is a massive leap forward for Payroll users.

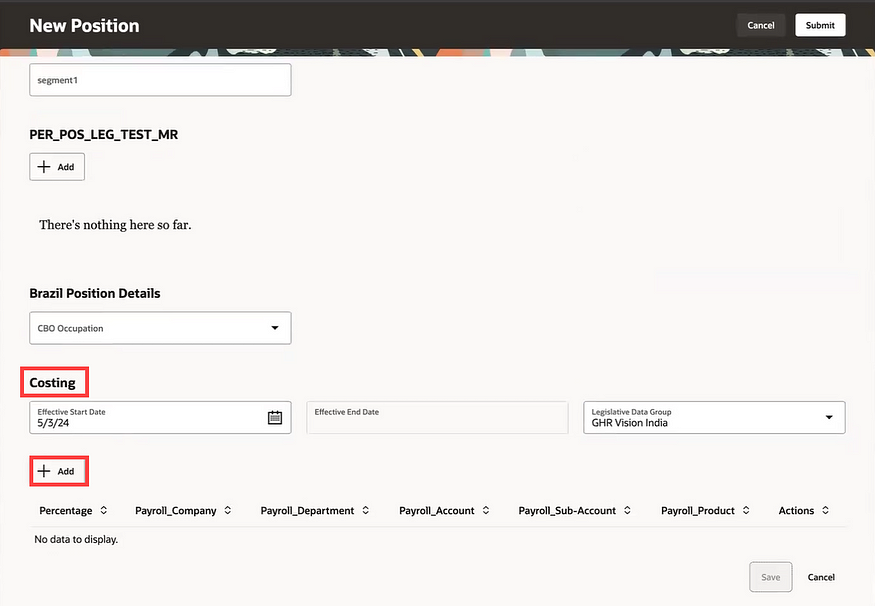

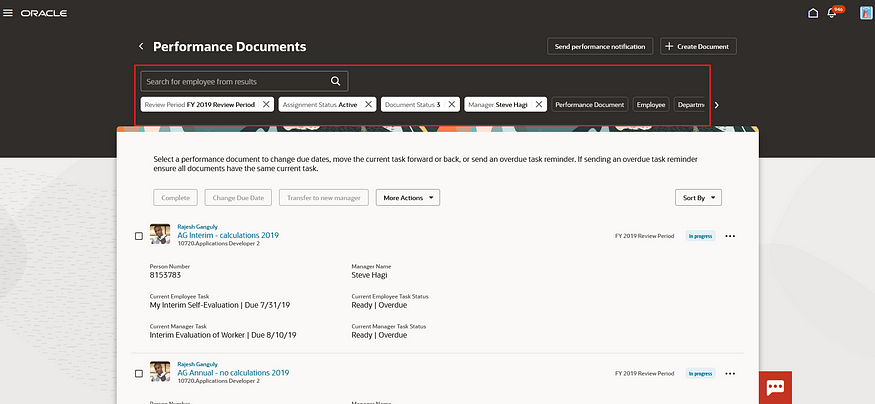

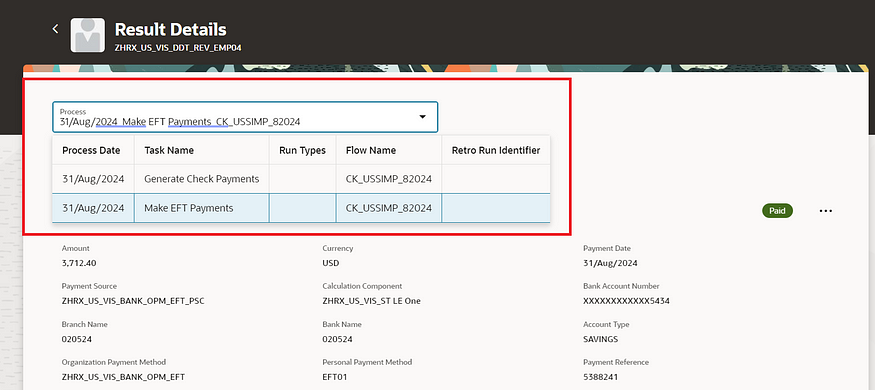

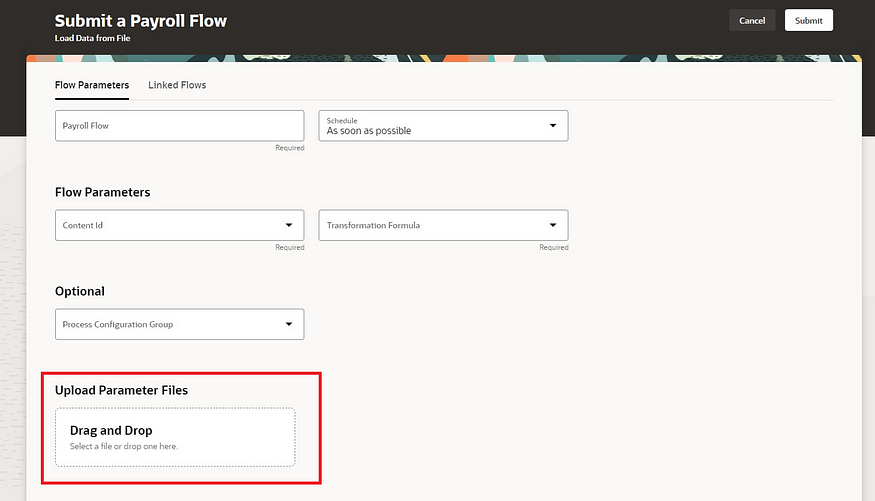

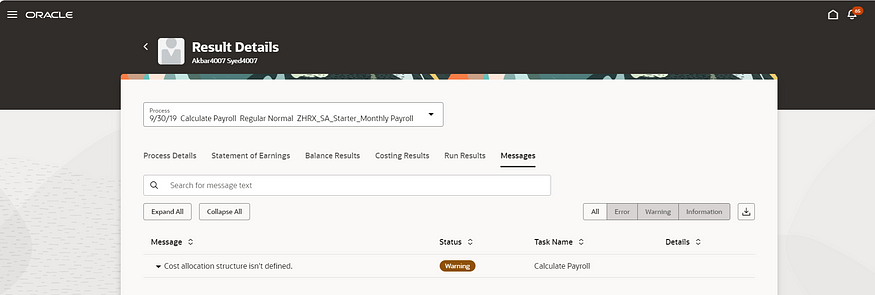

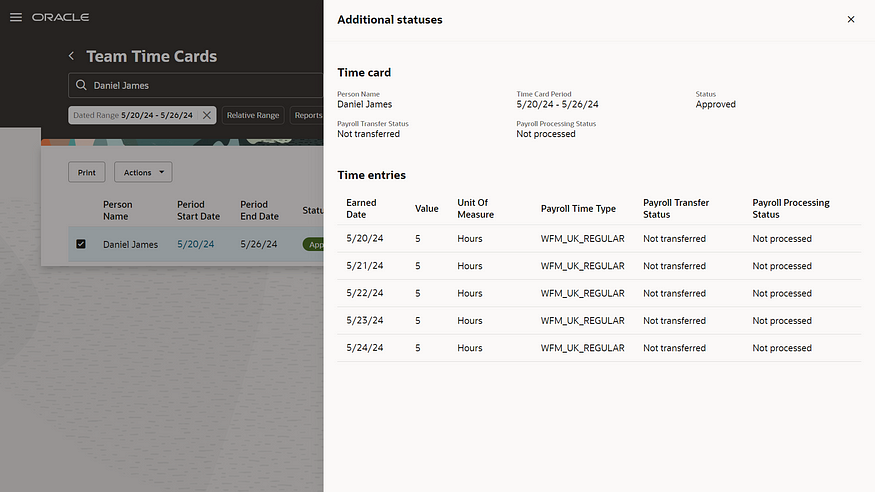

A number of pages have made the move to Redwood in this release. These include the Payroll Costing Setup and Process Summary pages. The Process Summary page allows for a high level summary of all payroll processes that have been submitted. The new page can either be accessed from the Payroll Quick Actions or the Payroll Activity Centre. This a much more user friendly way of reviewing any processes that have been submitted.

A new feature has been introduced to control how Retropay results are processed. Oracle have introduced the Retroactive Overpayment and Recovery for Earnings Elements process. How this differs from current behaviour is that rather than automatically processing the deduction for the overpayment in full, it is now offset resulting in no immediate impact to the employee’s net pay. You can then chose to setup and track repayments by the employee until it is paid back in full. This will ensure the fair recovery of overpayment.

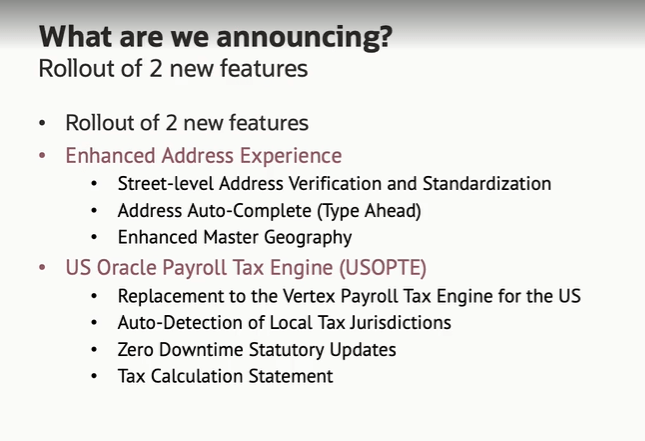

For those customers in the US, there is a significant change to US Payroll Engine. Oracle have introduced the new US Oracle Payroll Tax Engine (USOPTE) solution. The key change is that all statutory tax data information is now maintained and delivered by Oracle Cloud. These include wage limits, filing statuses and allowance amounts. The new Engine will also perform federal, state, and local tax calculations within the payroll product and provide improved visibility of tax calculations with a Tax Calculation Statement.

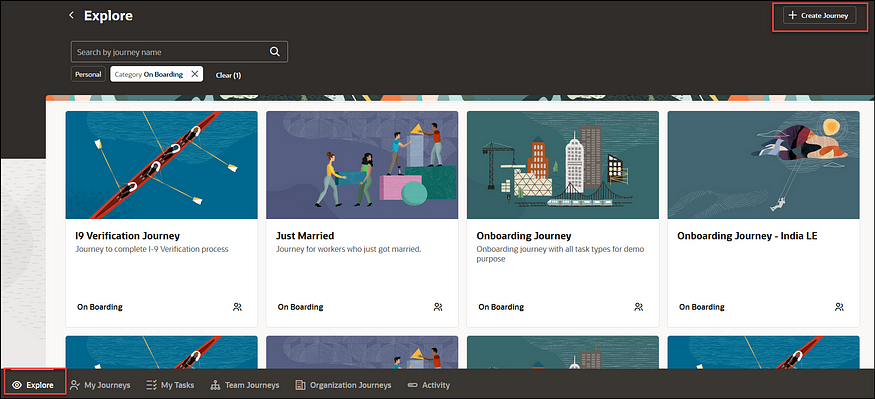

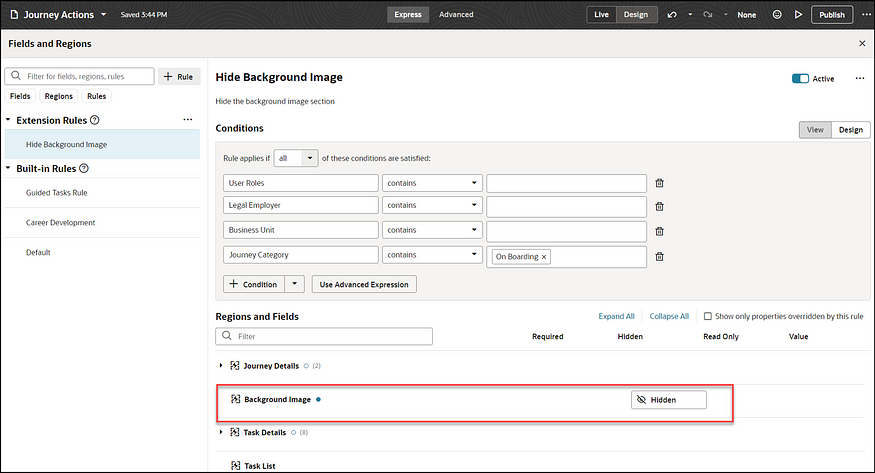

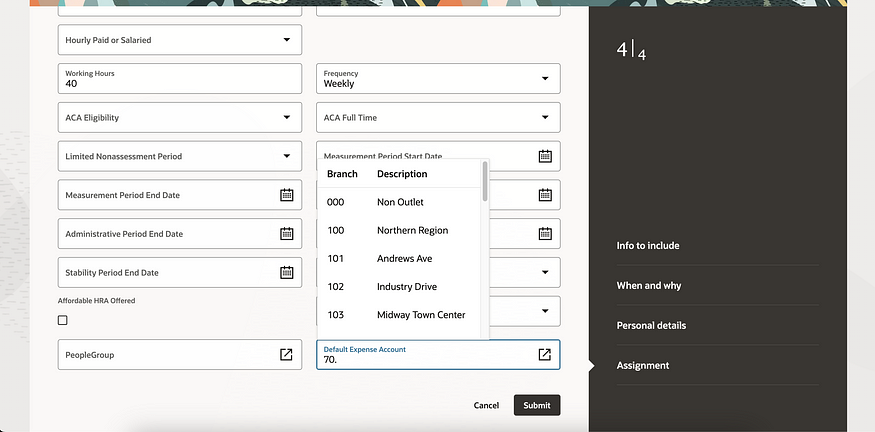

As mentioned earlier, Oracle often roll out new features throughout the month. Should these updates turn out to be significant, I’ll publish a refreshed blog post. Please check out my blog on the new features in Core HR for Release 25C here.

Please note all screenshots are the property of Oracle and are used according to their Copyright Guidelines