I’m a big fan of innovation, which is why I always look forward to the Oracle Fusion Quarterly Releases. While this one doesn’t bring a huge wave of new features for Global Payroll, there are still some important updates across various legislations worth noting. In this blog, I’ll give you a quick rundown of the key highlights from both the global and local perspectives. Oracle’s got plenty more in the pipeline this quarter, so keep your eyes peeled, and if anything particularly exciting crops up, I’ll be back with another post to keep you in the loop!

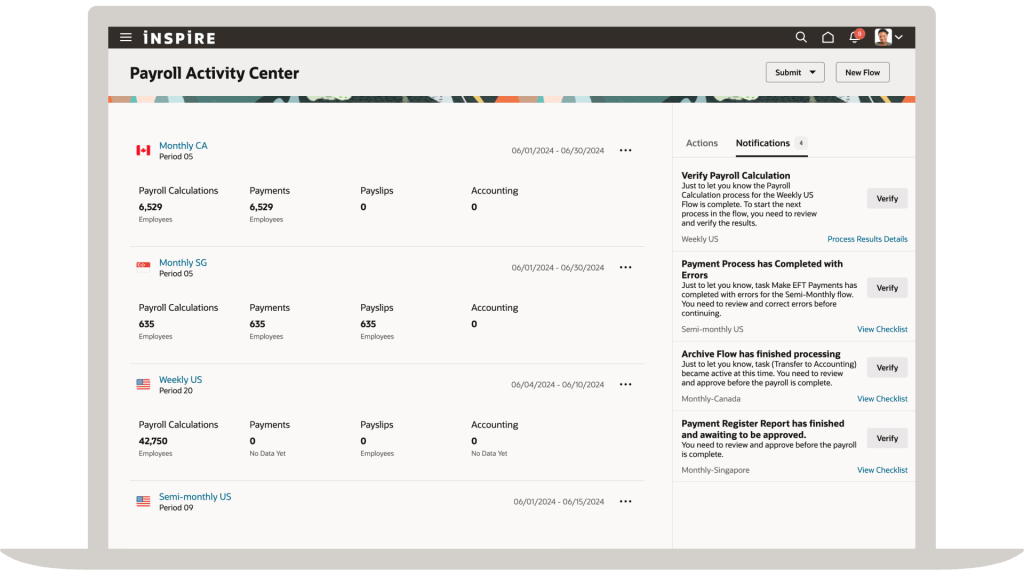

The first feature in Global Payroll is the new Redwood Archive Results page. Whilst this isn’t a glamourous new feature, it is an important page. The redesigned Redwood Archive Results page offers payroll admins the modern Redwood functionality for managing their payroll data with greater efficiency and accuracy. With enhanced navigation, flexible search, customisable views, and inline editing, it’s easier than ever to identify and resolve errors, unprocessed assignments, or missing records directly within the archive. These improvements help reduce manual effort, minimise rework, and ensure smoother payslip generation and external payment processing. The feature is enabled by default via the Redwood Payroll Activity Enabled profile option, so you don’t even need to do anything and can start benefiting straight away.

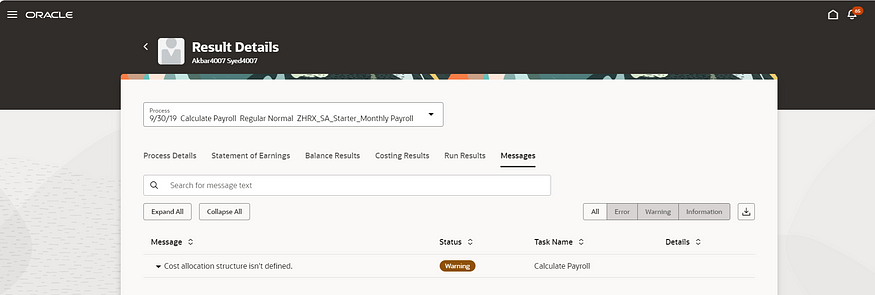

All Payroll admins know that reporting is critical to the job! Oracle have made a small, but helpful update to the Payroll Costing Report. Prior to 25D, the report was a standard BI Publisher output, but listening to feedback, Oracle have rewritten the report as an extract-based one. This new version will handle larger payroll volumes and has added in more report output options, including Excel, XML and text. There are some simple steps to enable this new version of the report. First go to the Switch Task Action Version flow. Select Run Payroll Costing Report from the task list, choose the Extract-based Report version, and set it as active. From then on, all flows using this task will automatically run with the new version.

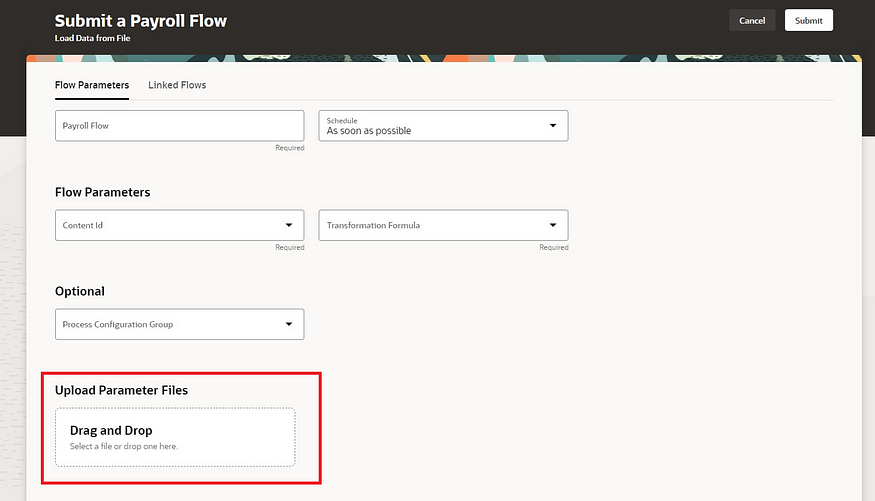

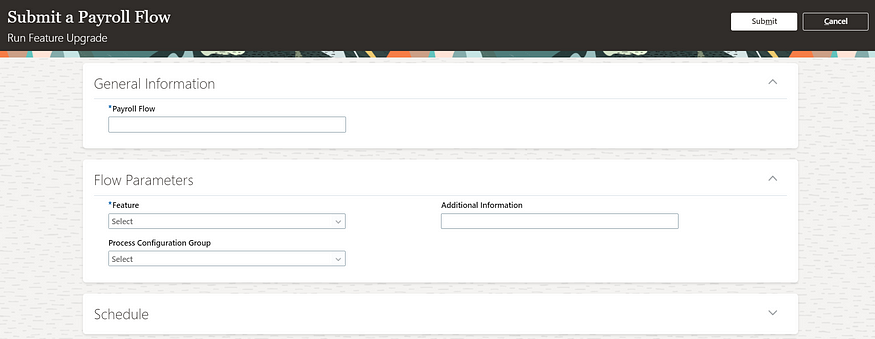

Moving on to the different legislations. There are a number of key features for Local Government in the UK. The first one is for the MCR for Teacher’s Pensions. A new input value, Error Number, is now available on the predefined TPS When Earned Details element, enabling employers to directly record error numbers linked to corrections for MCR files, particularly for When Earned U lines that typically require a TPS When Earned Details entry. This enhancement streamlines the reconciliation process for Teachers’ Pension errors. It’s easy to apply this update, navigate to Submit a Flow → Payroll, run the Run Feature Upgrade payroll flow task, and select Update Element Eligibility to Link Error Number for TPS When Earned Details Element.

There are two changes for LGPS included. Firstly a solution for the Pensionable Pay calculation for non-recurring payments. You can now easily work out the right Pensionable Pay for employees who’ve had time off mid-month and received one-off pensionable payments during their working days. With new balances in place, regular and irregular earnings are handled separately, so the LGPS employer contribution is calculated correctly without needing to prorate the monthly Pensionable Pay. Creating a new Main Pension Scheme element allows you to feed regular and irregular earnings into dedicated balances, ensuring accurate Pensionable Pay calculations for periods with one-off payments during working time. The second LGPS change relates to KIT and SPLIT days. You can now mark earnings as KIT or SPLIT days so they’re added to the right pensionable pay balances (CPP1 or CPP2). Just make sure to include the actual date worked when entering these, so the system can compare the day’s earnings with the assumed pensionable pay and use whichever is higher. If the day falls during unpaid leave, the full KIT or SPLIT earnings will be included in the pensionable pay.

With the introduction of Irish legislation for the first time, it is unsurprising that there are a significant number of new features in this release for it. These include Illness Benefit Payment or Offset; Public Sector Pensions; Salary Sacrifice; Send File Submission Process; Additional Superannuation Contribution (ASC) Forms; Check Revenue Submission Request; Payroll Submission Correction Request and Payslip Template. Additionally there are enhancements to reporting; Create Element template; Shadow Payroll; Special Assignee Relief Program and Withholding Taxes only on Irish Income. We know a few of you are already ahead of the curve when it comes to Irish legislation, so this’ll definitely be of interest. But even if you’re just starting to think about switching to Oracle Payroll, it’s still worth a look for our Irish customers.

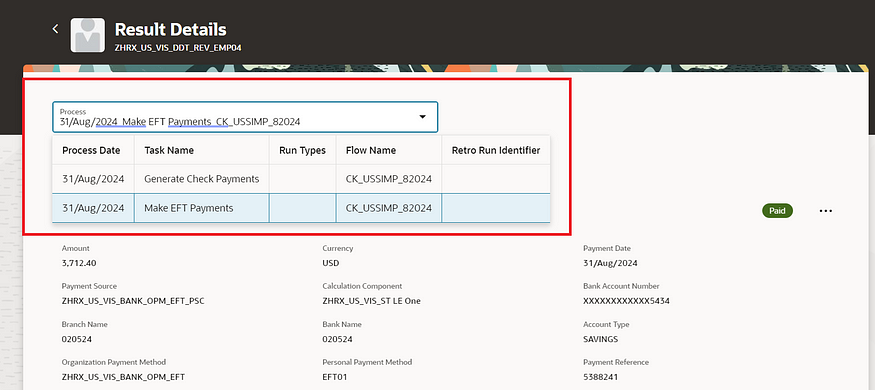

There’s just one update this time for our US customers, but it’s worth flagging. The Retroactive Overpayment and Recovery for Earnings Elements feature is now switched on by default. Honestly, I can’t think why you wouldn’t want to use it, but just so you know, it’s no longer optional. This functionality gives you more control over how Retropay results are managed, especially when they reduce an employee’s net pay. Instead of the full overpayment being automatically deducted, you can now set up a repayment plan for the employee.

As I mentioned earlier, Oracle tend to roll out new features throughout the month. If any of these updates turn out to be game-changers, I’ll pop up a fresh blog post to keep you in the loop. In the meantime, feel free to check out my latest write-up on the new Core HR features in Release 25D, you can find it here.

Please note all screenshots are the property of Oracle and are used according to their Copyright Guidelines