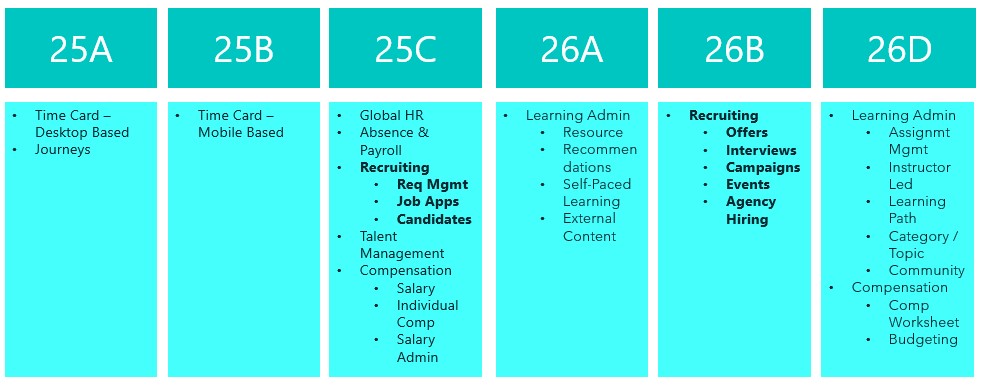

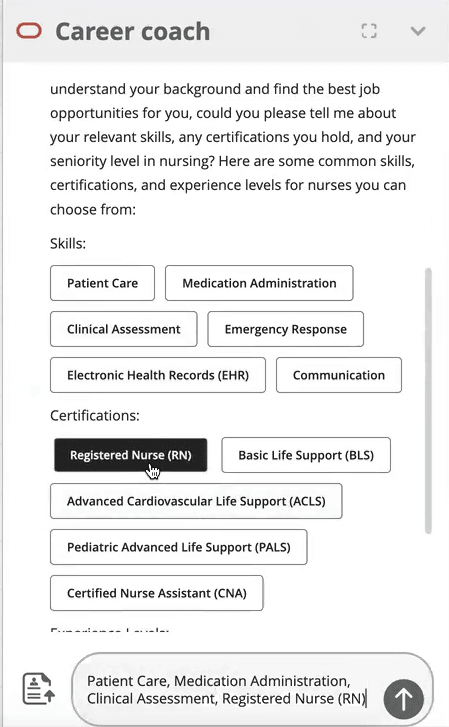

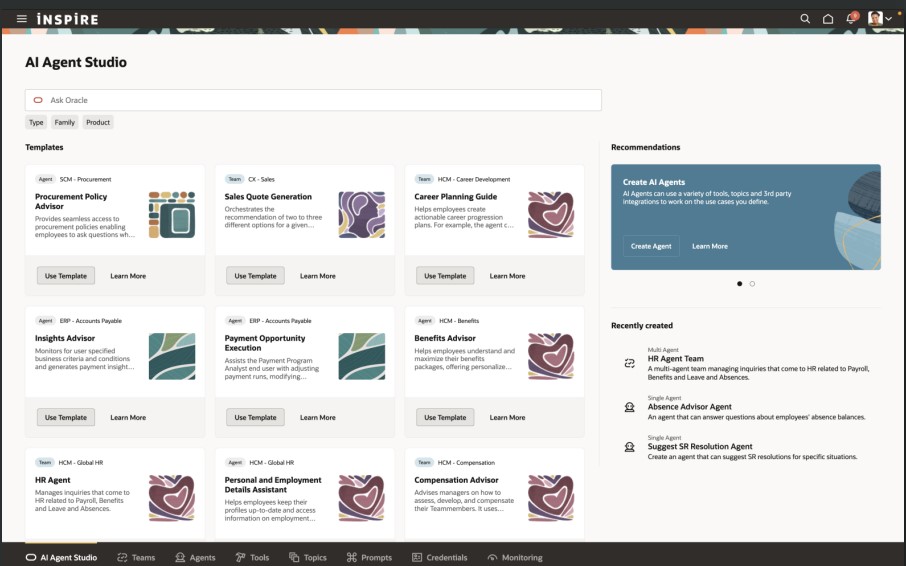

Release 25D has landed, and Oracle are gearing up for phase 2 of Redwood for Learn—this time turning the spotlight on Learn Admin pages, which are mandatory by release 26A. The focus is on making things smoother and smarter when it comes to resources, recommendations, self-paced learning, and external content. With the deadline fast approaching, it’s no surprise there’s a whole bunch of handy features to help you make the switch. Let’s dive in and see what’s new!

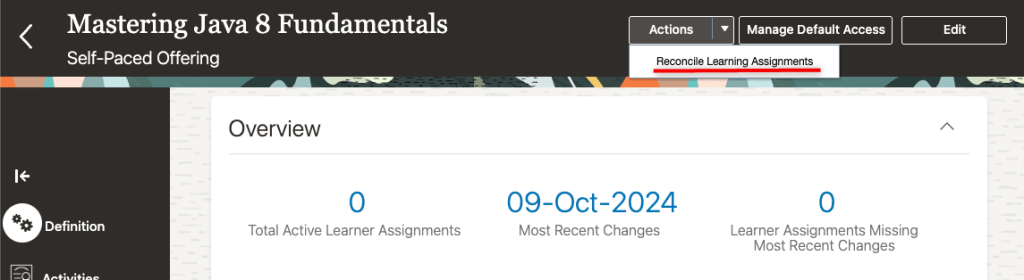

If you’re someone who often forgets to reconcile learning assignments, this new feature is for you. With just a quick tweak to a profile value, any course, offering, specialisation, or self-paced learning you kick off will now automatically trigger the reconciliation process. That means all your linked learning assignments stay up to date, saving you from the hassle of mismatched or outdated info.

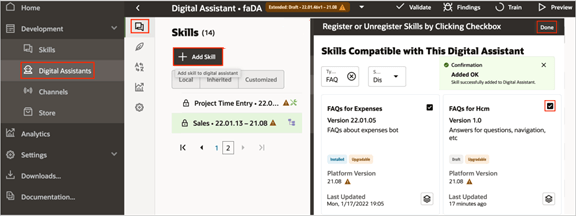

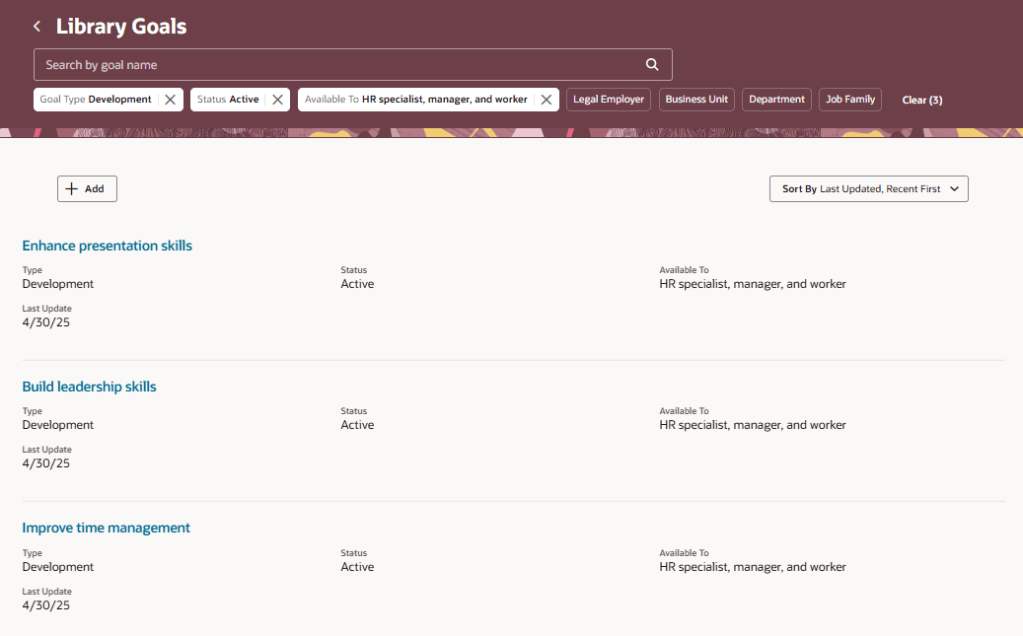

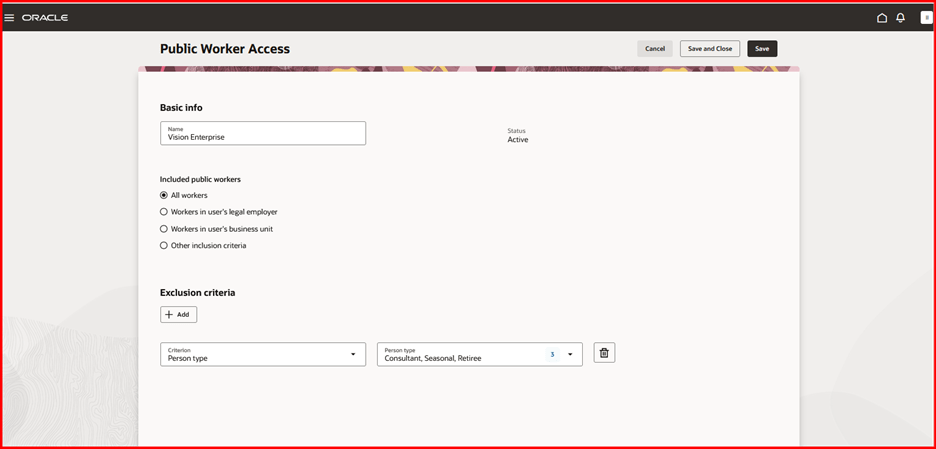

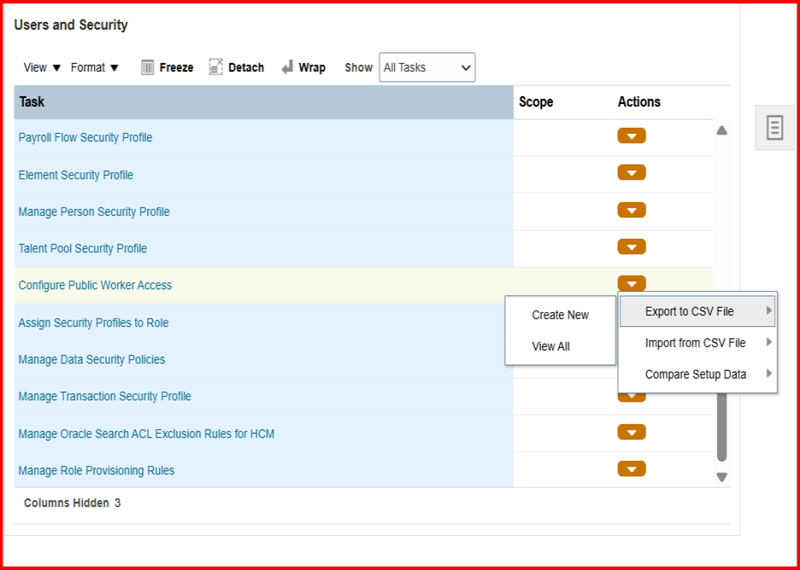

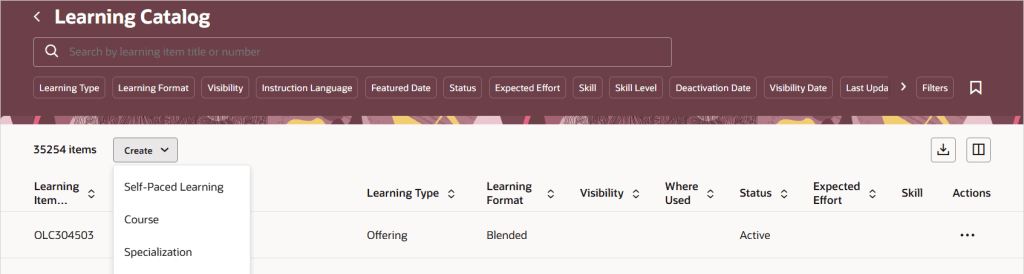

25D is bringing with it a new unified catalogue listing page, which will be your central location for all your Learn admin tasks. This new feature changes how admin access works for courses, specialisations, and offerings. Once you switch to the single learning catalogue view, courses, offerings, and specialisations will show up on the Learning Catalogue page. Just a heads-up: the old data security rules won’t apply anymore for the following tasks: viewing, managing courses, offerings, or specialisations in the catalogue. If your admins already have full access, there’s nothing you need to do. If you’ve been limiting access to certain items, now’s a great time to simplify things using catalogue administration profiles. Just set up profiles that define who can manage what, replacing the old security roles. Then, link your courses, offerings, and specialisations to the right profile—HCM Data Loader (CourseV3, OfferingV3, and SpecializationV3) can help with bulk updates.

If your organisation uses external learning content, you can now set default visibility rules for each provider, deciding who gets access and how the content shows up in topics and communities. It’s a great way to make sure the right people see the right stuff in the right places, all while keeping things aligned with your learning strategy. This update gives you more control over how third-party content is delivered, helps avoid misuse, and lets you manage licensing costs more efficiently. To get started, just head to My Client Groups > Learning and Development > Configure External Provider and tweak the audience and catalogue settings for any providers whose content is imported as self-paced learning.

With learning content getting better and richer, it’s no surprise the file sizes are growing too. Oracle’s on the ball, they’ve upped the max file size for Self Paced Learning, so you can now upload videos, SCORM packages (1.2 and 2004), AICC ZIPs, and presentations up to a whopping 2GB. PDFs are still capped at 1GB, but that should cover most needs. If you’ve already got Self Paced Learning switched on, there’s nothing you need to do—just enjoy the extra space!

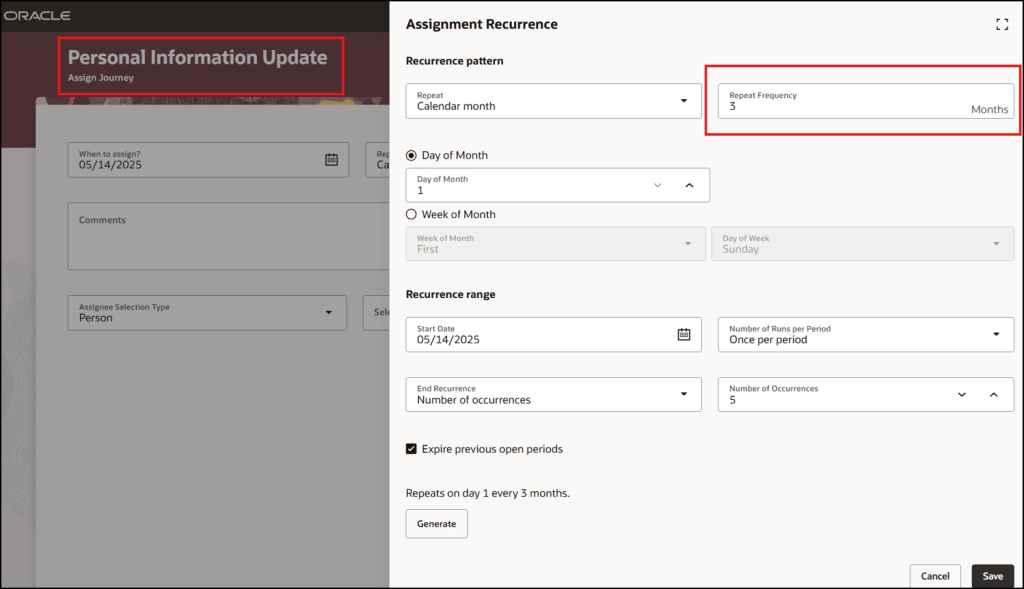

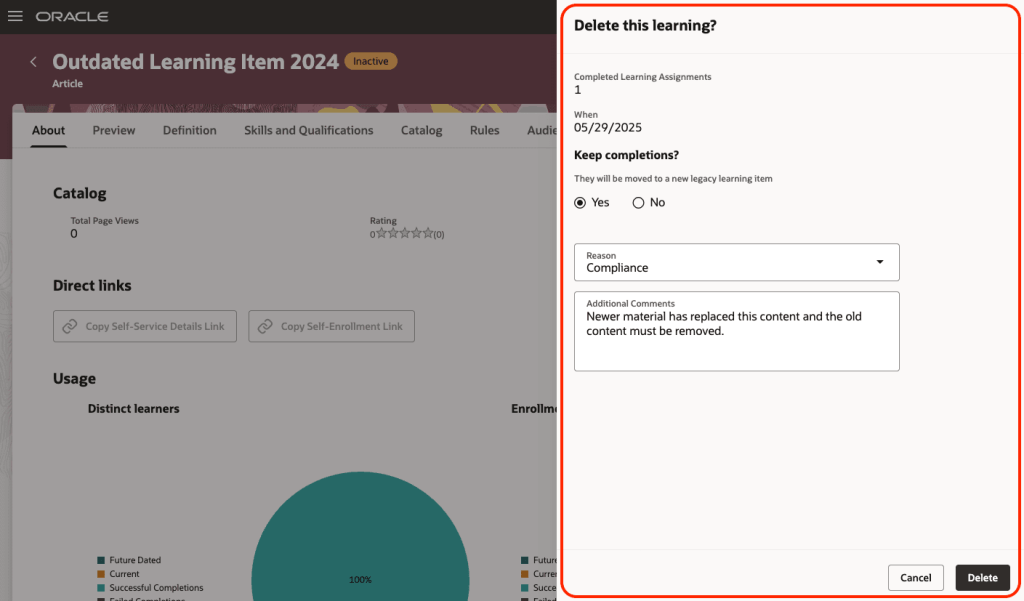

The final feature I want to highlight, is one that has been a frustration for many people and now it has been resolved. You can now clear out old self-paced learning from your Oracle Learning catalogue—whether it’s inactive or has missing content. Just click the new Delete button and you’ll see how many people completed it. You can choose to keep those completions by moving them to a legacy item, note down a reason for deleting it, and add a quick comment if you like. Once you confirm, the system runs a scheduled process that permanently removes the learning and all its links—like specialisations, communities, recommendations, initiatives, HCM goals and journeys. If you’ve chosen to keep completions, they’ll be safely moved so learner history isn’t lost. Just make sure self-paced learning is switched on and that you’ve added the new security privilege: WLF_DELETE_LEARNING_CATALOG_ITEM_PRIV.

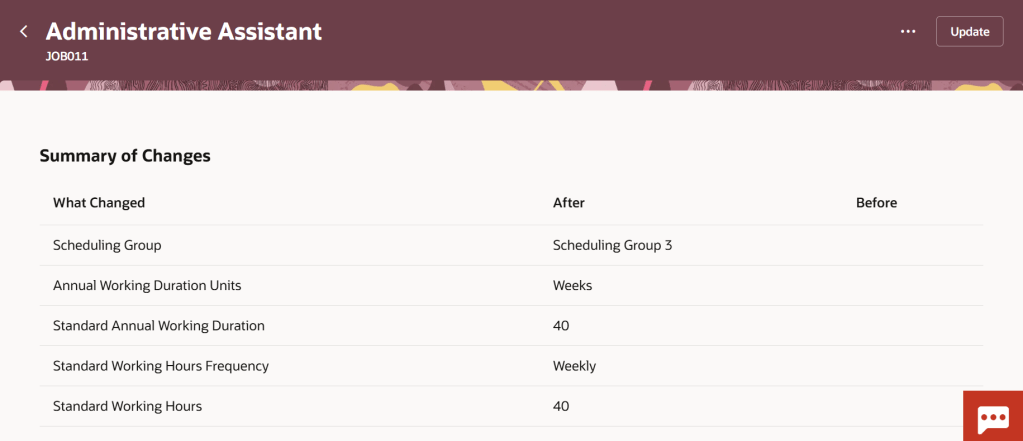

Oracle often slip in a few extra new features throughout the month, so it’s always worth keeping an eye out. If anything truly exciting drops, I’ll put up another blog post to keep you in the know and make sure you’re not missing out. In the meantime, please check out my latest write-up on the new Core HR features in Release 25D, you can find it here.

Please note all screenshots are the property of Oracle and are used according to their Copyright Guidelines