It’s that time again, quarterly release time, and there’s plenty to look forward to! With Oracle’s strong focus on AI, Release 26A promises some exciting updates. Oracle often adds extra features throughout the month, so keep an eye out for more enhancements as they arrive. This release is especially important for UK Payroll customers, as it includes all the new tax year functionality.

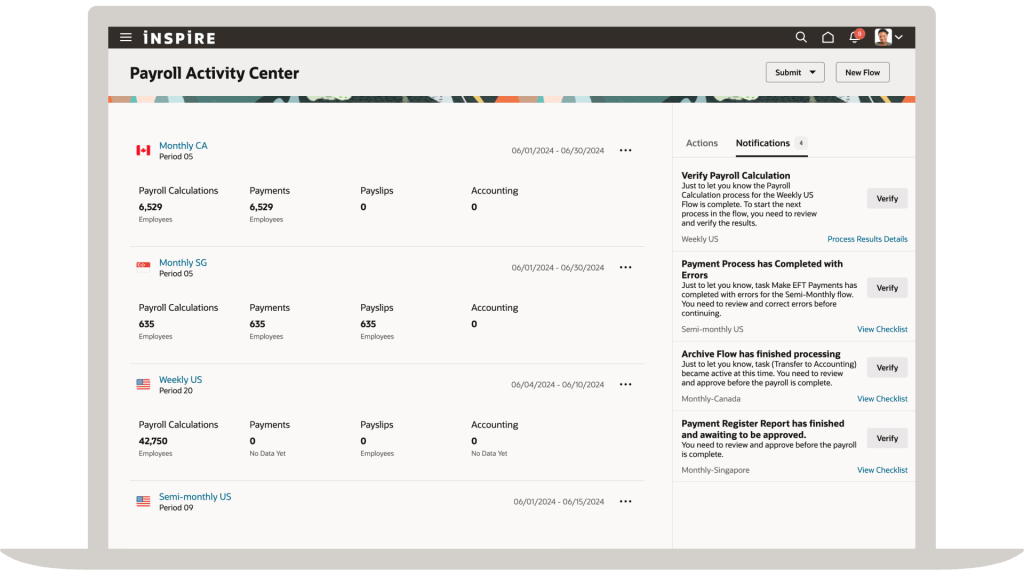

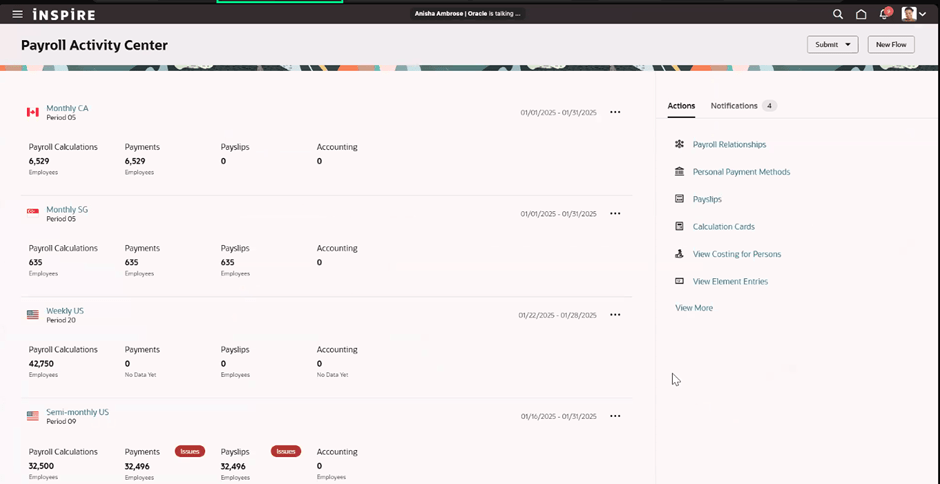

Global Payroll introduces an exciting new AI-powered tool, the Payroll Administrator Troubleshooting Agent. Known as the Payroll Run Analyst, this assistant helps payroll administrators validate employee payroll results directly from the Payroll Results page, including reviewing statements of earnings. Built on Oracle’s AI Agent framework, it delivers secure, role-based information within your permissions and significantly reduces manual effort during payroll reconciliation. It also streamlines corrective actions with deep links to related HCM pages, such as earnings and deductions, for quick updates. Best of all, it requires no extra setup and is ready to use immediately, with a chat experience coming in a future release.

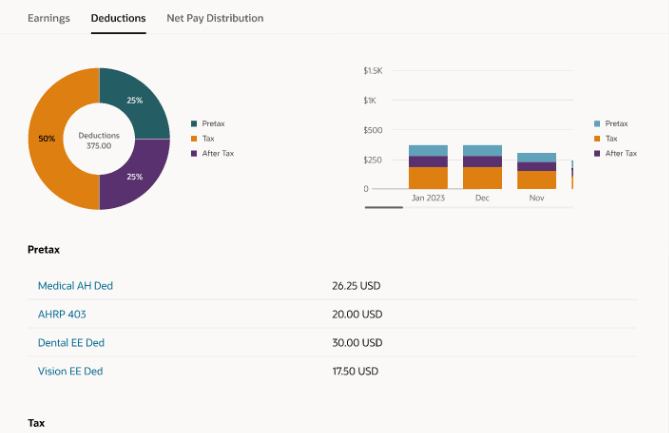

Another feature worth highlighting is the redesign of payslip templates using the Redwood toolkit. The new Redwood Payslip offers a far better experience than the previous responsive version, but until now it only worked with the seeded payslip, which most organisations don’t use. With this update, the Redwood payslip can be viewed online or downloaded, and the PDF/UA templates are fully accessible while meeting all legislative requirements for payslip reporting. To stay compliant with local regulations, Oracle recommend adopting the Redwood payslip template as soon as possible.

As mentioned earlier, this release includes the UK legislative updates for the new tax year. Please note that a monthly patch may be required to incorporate any additional changes announced by the UK Government closer to April. One key update relates to the Full Payment Submission (FPS). You can now choose whether employee addresses are reported for all employees or only new starters. This option applies to the FPS processes for tax years ending April 2025 and April 2026. To set this, use the new field Employee Address on FPS from Tax Year 2024–25 on the organisation-level Statutory Deductions calculation card. By default, this is set to All Employees.

There’s also an update to the P60 template for the 2025/26 tax year. A new Statutory Neonatal Payment field has been added to the Statutory Payments section of the P60, along with a corresponding balance in the UK Balances for the End-of-Year Archive group. To generate and issue P60 End-of-Year Statements to employees, use the updated templates for 2025/26: Type LE(P), eP60 – Online and Plain Paper.

New payroll attributes have been introduced to help organisations set up adoption, maternity, and paternity absences for calculating benefit payments or offsets. Detailed steps are provided to guide you through creating the necessary elements, entitlement formula result rules, balance feeds, and validation formulas based on delivered templates. You’ll also find instructions for setting up entitlement formulas, certificates, absence plans, and absence types, ensuring a smooth and compliant process.

Oracle has now introduced Advance Pay for Irish legislation, giving employees the option to request payment before going on holiday. The amount is then recovered over a set period, such as weekly, bi-weekly, or lunar cycles, as needed. Before processing Advance Pay, make sure all other earnings and deductions have been completed. You’ll also need to configure Advance Pay usage and ensure that earnings are correctly processed during the holiday period.

Enhanced Reporting Revenue (ERR) Requests are now available, making compliance easier. After payroll runs and prepayments that include ERR element entries, use the Run Enhanced Reporting Submission Request. You can also run this process for a specific time period to report on unprocessed ERR entries, such as Travel and Subsistence, Remote Working Daily Allowance, and Small Benefit Exemption. The process generates three outputs: an ERR Audit Report showing archived employee and element details, an Errors and Warnings report, and a JSON file for Revenue submission via the Send File Submission process. For corrections, use the Run Enhanced Reporting Correction Request on previously submitted ERR files. This creates a revised JSON file, an ERC Audit Report, and an Errors and Warnings report—ready to send to Revenue.

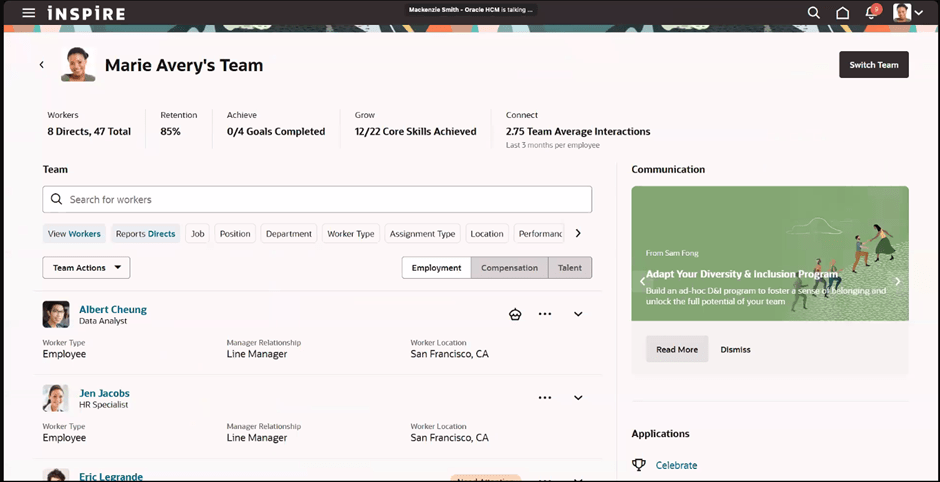

As I mentioned earlier, Oracle usually drops extra features throughout the month, so keep an eye out! If anything really exciting comes along, I’ll post an update to make sure you’re in the loop. In the meantime, why not check out my latest blog on the new Core HR features in Release 26A? You can find it here.

Please note all screenshots are the property of Oracle and are used according to their Copyright Guidelines